where's my unemployment tax refund tool

When the tax return is received when the refund is approved and when the refund is sent. An immediate way to see if the IRS processed your refund is by viewing your tax records online.

Unemployment Income And Why You May Want To Amend Your 2020 Tax Return

Child tax credit and unemployment insurance claims.

. Using the IRS tool Wheres My Refund go to the Get Refund Status page. Just got my transcript updated with the unemployment tax refund date of 818. The IRS provides three updates.

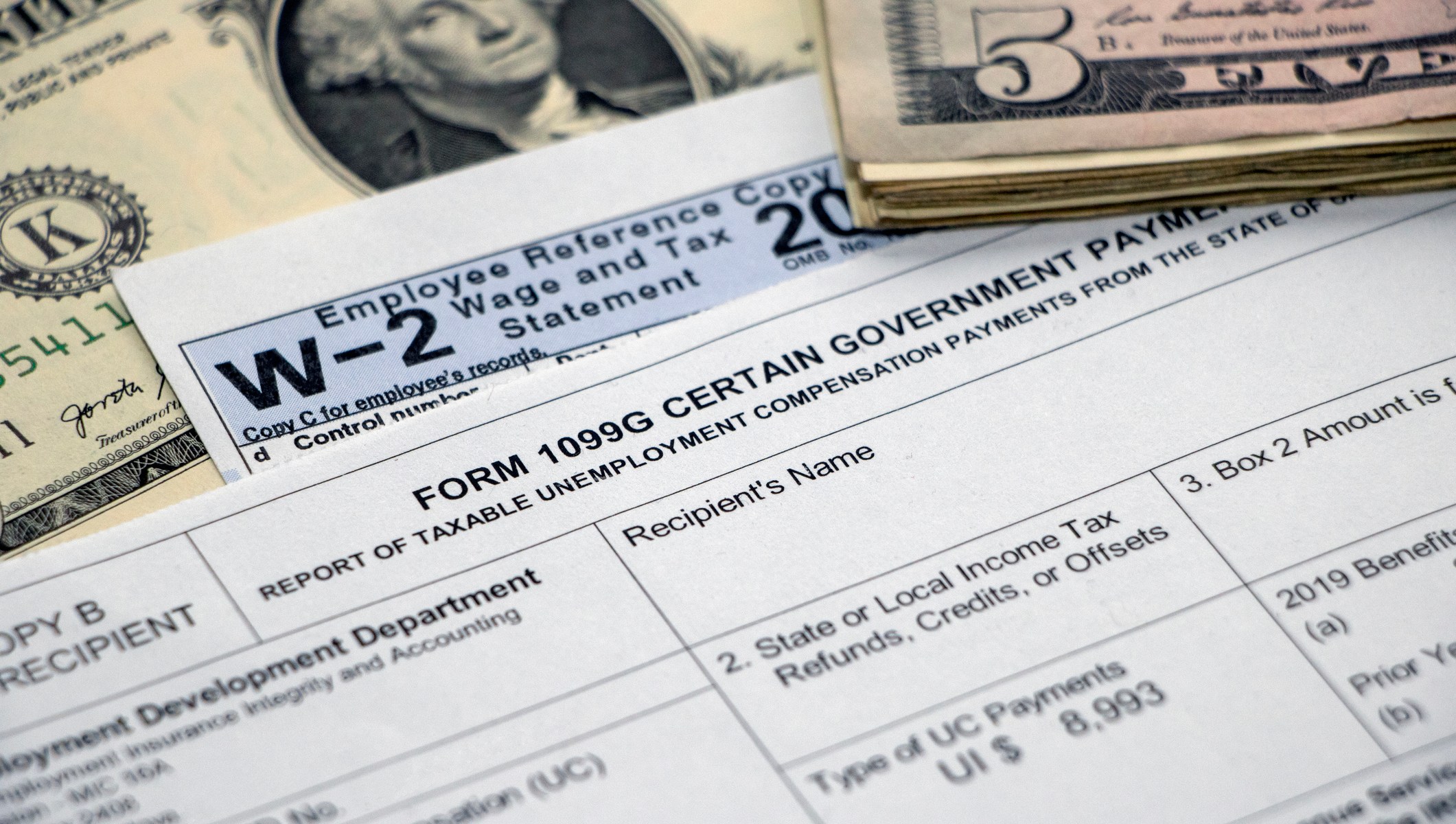

The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer. The tool is specially designed for all desktop users and if you are an app user then you can go to the IRS2go application and do the rest. The 10200 exemption applied to individual taxpayers who earned less than 150000 in modified adjusted gross income.

The American Rescue Plan Act allows eligible taxpayers to exclude up to 10200 up to 10200 for each spouse if married filing jointly from their gross income which will likely lower the tax liability. If those tools dont provide information on the status of your unemployment tax refund another way to see if the IRS processed your refund is by viewing your tax records online. Heres how to check online.

It allows you to check the status of your refunds for the 2021 2020 and 2019 tax years. By Anuradha Garg. Check your unemployment refund status by entering the following information to verify your identity.

Your Adjusted Gross Income AGI. The first 10200 of 2020 jobless benefits 20400 for married couples filing jointly was made nontaxable income by the American Rescue Plan in March. Updated March 23 2022 A1.

September 13 2021. This is available under View Tax Records then click the Get Transcript button and choose the. To avoid delays the.

Making a phone call to the Internal Revenue Service IRS at 1-800-829-1040 You may have to wait a long time to speak with someone. These updated FAQs were released to the public in Fact Sheet 2022-21 PDF March 23 2022. Another way is to check your tax transcript if you have an online account with the IRS.

The only way to see if the IRS processed your refund online is by viewing your tax transcript. These letters are sent out within 30 days of a correction being made and will tell you if youll get a refund or if the cash was used to offset the debt. Using the IRS tool Wheres My Refund go to the Get Refund Status page enter your SSN or ITIN filing status and exact refund amount then press Submit.

Will I receive a 10200 refund. 22 2022 Published 742 am. Viewing the details of your IRS account.

For this round the average refund is 1686 direct deposit refunds started going out Wednesday and paper checks today. Enter the amount of tax withheld from Form 1099-G Box 4 on line 25b of your Form 1040 or Form. The Internal Revenue Service is delivering a fourth round of special tax refunds this week to 15 million taxpayers who paid taxes on unemployment benefits when they filed their 2020 tax returns.

Whether you owe taxes or are awaiting a refund you may check the status of your tax return by. Free Unemployment Tax Filing Prepare and E-file Your Federal Taxes for 0. Just checked my bank and the CTC is there.

In the latest batch of refunds announced in November however the average was 1189. The IRS has a new Wheres My Refund tool. You can also request a copy of your transcript by mail or through the IRS automated phone service by calling 1-800-908-9946.

From 2021 the FUTA tax rate is 60 and it applies to the first 7000 in annual wages paid per employee. You can use the IRS online tracker applications the Wheres My Refund and Amended Return Status tools. If you entered your information correctly.

It is available on IRSgov or the IRS2Go mobile app. As you are already aware you can use the wheres my refund tool introduced by the Internal Revenue Service for all of your tax refunds. Your employer on the other hand may be eligible for a credit of up to 54 of FUTA taxable wages if.

You will need your Social Security number or ITIN filing status and expected refund amount from their original tax return for the year you are checking. After entering the below information you will also have the option of being notified by text or e-mail when the status of your. But the unemployment tax refund can be seized by the IRS to pay debts that are past due.

Using the IRSs Wheres My Refund feature. Since May the IRS has been making adjustments on 2020 tax returns and issuing refunds averaging around 1600 to those who can claim an unemployment tax break. The agency said at the beginning of.

Check My Refund Status Wheres My Refund. The Internal Revenue Service doesnt have a separate portal for checking the unemployment compensation tax refunds. Millions of Americans who collected unemployment benefits last year and paid taxes on that money are in line to receive a federal refund from the IRS this year.

Visit Refund Status on MassTaxConnect. The unemployment benefits were given to workers whod been laid off as well as self-employed people for the first time. The IRS online tracker applications aka the Wheres My Refund tool and the Amended Return Status tool will not likely provide information on the status of your unemployment tax refund.

Check your unemployment refund status using the Wheres My Refund tool like tracking your regular tax refund. The Department of Labor has not designated their state as a credit. They fully paid and paid their state unemployment taxes on time.

The unemployment tax refund is only for those filing individually. Use the Wheres My Refund tool or the IRS2Go mobile app to check your refund online. The exact refund amount will depend on the persons overall income jobless benefit income and tax bracket.

Also the CTC portal is still not showing my August payment.

![]()

What To Know About Unemployment Refund Irs Payment Schedule More

How To Check Your Tax Refund Status Turbotax Tax Tips Videos

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Unemployment Tax Break Refund How To Check Your Irs Transcript For Clues

Waiting For Your Unemployment Tax Refund About 436 000 Returns Are Stuck In The Irs System

Irsnews On Twitter Use The Where S My Refund Tool To Start Checking The Status Of Your Refund 24 Hrs After Irs Acknowledges Receipt Of Your E Filed Tax Return You Can Access The

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Here S How To Track Your Unemployment Tax Refund From The Irs

Irs Sending Out More 10 200 Unemployment Tax Refund Checks Here S How To Track Your Payment

Unemployment Tax Refunds Irs To Send More Payments Before End Of Year Gobankingrates

Where S My Refund Where S My Refund Status Bars Disappeared We Have Gotten Many Comments And Messages Regarding The Irs Where S My Refund Tool Having Your Orange Status Bar Disappearing This Has

Unemployment Tax Updates To Turbotax And H R Block

Some 2020 Unemployment Tax Refunds Delayed Until 2022 Irs Says

Irs Issued 430 000 More Unemployment Tax Refunds What To Know Cnet

Unemployment Stimulus Am I Eligible For The New Unemployment Income Relief The Turbotax Blog

Irs Starts Sending Unemployment Benefits Tax Refunds To Millions Of Taxpayers Plus More Special Refunds Payments On The Way

Your Tax Refund May Be Late The Irs Just Explained Why The Washington Post